wells fargo class action lawsuit 2018

Wells Fargo Company NYSE. District Court for the Northern District of California.

Wells Fargo Workers Win Approval For 32 5 Million 401 K Deal

On May 30 2018 a California federal judge granted final approval for a 142 million class action settlement over claims that Wells Fargo opened fake bank accounts despite many arguments that the settlement is insufficient.

. 20 2018 113 pm. These big banks dont have the right to charge overdraft fees and they must pay you back to protect their reputation. The courts approval of the broad and far-reaching 142 million settlement.

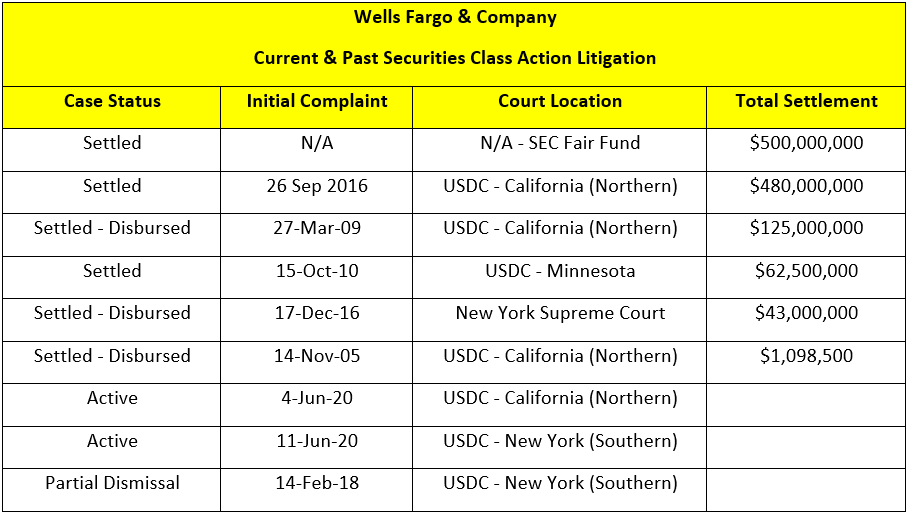

A 142 million class-action lawsuit settlement known as Jabbari v. The judgment handed down late Tuesday comes. This month an agreement was finalized under which Wells Fargo will pay 480 million to settle a class-action claim by shareholders who said they were harmed by the banks false statements about.

The two named plaintiffs Donald McCoy and Maximiliano Olivera said in the class action suit that they sent numerous request for information letters to. May 4 2018. On Wells Fargo Overdraft Lawsuit Payout.

Wells Fargo announced late last week that it has settled a securities fraud class-action lawsuit concerning its fake account scandal as the bank has agreed to pay 480 million. Wells Fargo Cos legal tab keeps blowing up. District Court for the Northern District of California.

Wells Fargo Bank NA. The financial corporation has found itself facing consumer backlash regarding alleged unfair operations of the bank potential unethical practices and more which have resulted in a range of class action lawsuits being filed. This would have allowed plaintiffs to collect more money through class action.

Between September and October 2018 Wells Fargo sent letters to approximately 870 customers who had applied for a mortgage modification between April 13 2010 and April 2018 but were denied a modification. 2 days agoIn April Wells Fargo chief executive Charlie Scharf said it could be several more years before the bank escapes the shadow of the 193 trillion asset cap placed on Feb. While it has been reported that some lenders have refused to approve Black applicants the class action lawsuit against Wells Fargo has been filed in the Northern District of California.

Wells Fargo has committed to or already provided restitution to consumers in excess of 600 million through its agreements with the OCC and CFPB as well as through settlement of a related consumer class-action lawsuit and has paid over 12 billion in civil penalties to the federal government and to the City and County of Los Angeles. A federal judge has ordered Wells Fargo to pay 973 million in damages to mortgage workers in California who werent paid enough for their breaks. The Wells Fargo lawsuit filings follow claims of the bank unfairly repossessing property customers receiving mortgage forbearances they didnt ask for.

The Wells Fargo lawsuit 2018 settlement was announced in December. 529 PM ET Wells Fargo draws bipartisan anger from Congress. WFC today announced the class-action lawsuit settlement concerning improper retail sales practices Jabbari v.

For the 394 million settlement Wells Fargo is estimated to pay 385 million and National Guard will cover the remaining 75million. Purple Mountain Trust v. Wells Fargo has admitted that these homeowners were wrongful denied a modification due to a software glitch with Wells Fargos internal system.

Wells Fargo will pay 480 million to settle securities fraud lawsuit by Matt Egan MattEganCNN May 4 2018. The recent 203 million Wells Fargo overdraft lawsuit payout highlights the problem with big banks unfair practices and is a clear example of how you can take legal action against them. A federal judge in San Francisco has given final approval to a 480 million deal that settles a shareholder class-action lawsuit against Wells Fargo.

Wells Fargo Bank NA received final approval in a June 14 order from the US. The courts approval of the broad and far-reaching 142 million settlement agreement is a significant step forward in making things right for our customers. Further it may have been easier to reach a settlement in a class-action suit.

The company allegedly failed to update the information on their customers credit reports after Chapter 7 bankruptcy. Wells Fargos tab for its sham accounts scandal shot up again on Friday when the bank agreed to pay 480 million to settle a class-action claim from shareholders who said they were. Wells Fargo Company et al.

The plaintiffs in the Wells Fargo class action claim filed against the bank in late 2018 claimed that the company mishandled the bankruptcy proceedings of their clients. In addition to paying out a portion of the claims Wells Fargo will also cover legal costs which total 365 million. In May Wells Fargo agreed to pay 480 million to settle a class-action securities fraud lawsuit brought by investors who alleged the bank made misstatements and omissions in its disclosures about.

Wells Fargo Company and two of its top executives are facing a proposed class action lawsuit that claims the defendants failed to reveal to investors the extent of the banks illicit practices between January 13 2017 and July 27 2017. February 16 2018 118-cv-01318. Negotiations have been hard according to the customers requesting approval for the class action settlement.

Using forced arbitration clauses to block class action litigation may have shielded Wells Fargo from responsibility. Has been approved by the US. On Friday the embattled bank agreed to pay 480 million to resolve a class action lawsuit brought by investors accusing the company.

May 7 2018.

Here S Every Wells Fargo Consumer Scandal Since 2015

Wells Fargo Wins Dismissal Of Shareholder Lawsuit Over Commercial Lending Reuters

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com

Wells Fargo Home Loan Class Action Settlement Top Class Actions

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Wells Fargo Wins Dismissal Of Shareholder Lawsuit Over Commercial Lending Reuters

Wells Fargo Must Face Shareholder Lawsuit Alleging Compliance Failures

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Refuses Black Female Judge In Class Action Racial Discrimination Case

Us Government Fines Wells Fargo 3 Billion For Its Staggering Fake Accounts Scandal Cnn Business

Wells Fargo Settles Class Action Lawsuit And Cuts Overdraft Fees

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Wells Fargo Settles Class Action Lawsuit And Cuts Overdraft Fees

Neo4j Going Distributed With Graph Database Technology Innovations Innovation Technology Graph Database Big Data Technologies

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement